Navigating the Landscape of Progressive Southeastern Insurance Companies: An NAIC Perspective

Understanding the insurance market, particularly in the southeastern United States, requires a nuanced approach. The term “progressive southeastern insurance company naic” encompasses several key aspects: the financial stability and regulatory oversight provided by the National Association of Insurance Commissioners (NAIC), the geographic focus on the southeastern region, and the innovative or “progressive” nature of certain insurance providers. This article aims to provide a comprehensive overview of these elements, offering insights into how these companies operate, their significance in the insurance landscape, and what policyholders should consider when making informed decisions. We’ll explore the NAIC’s role in ensuring solvency and fair practices, examine the unique challenges and opportunities within the southeastern market, and delve into what makes an insurance company truly progressive.

Understanding the NAIC’s Role in Southeastern Insurance

The National Association of Insurance Commissioners (NAIC) plays a pivotal role in regulating the insurance industry across the United States. Its primary function is to protect policyholders by ensuring the financial solvency of insurance companies and promoting fair and consistent regulatory practices. The NAIC does not directly regulate insurance companies but provides a forum for state insurance regulators to coordinate their efforts and develop model laws and regulations that states can adopt. This coordination is particularly important in a region like the Southeast, where economic conditions and demographic trends can significantly impact the insurance market.

The NAIC’s key activities include:

- Financial Regulation and Accreditation: Establishing financial solvency standards and accrediting state insurance departments that meet those standards. This ensures that insurance companies operating in accredited states are subject to rigorous financial oversight.

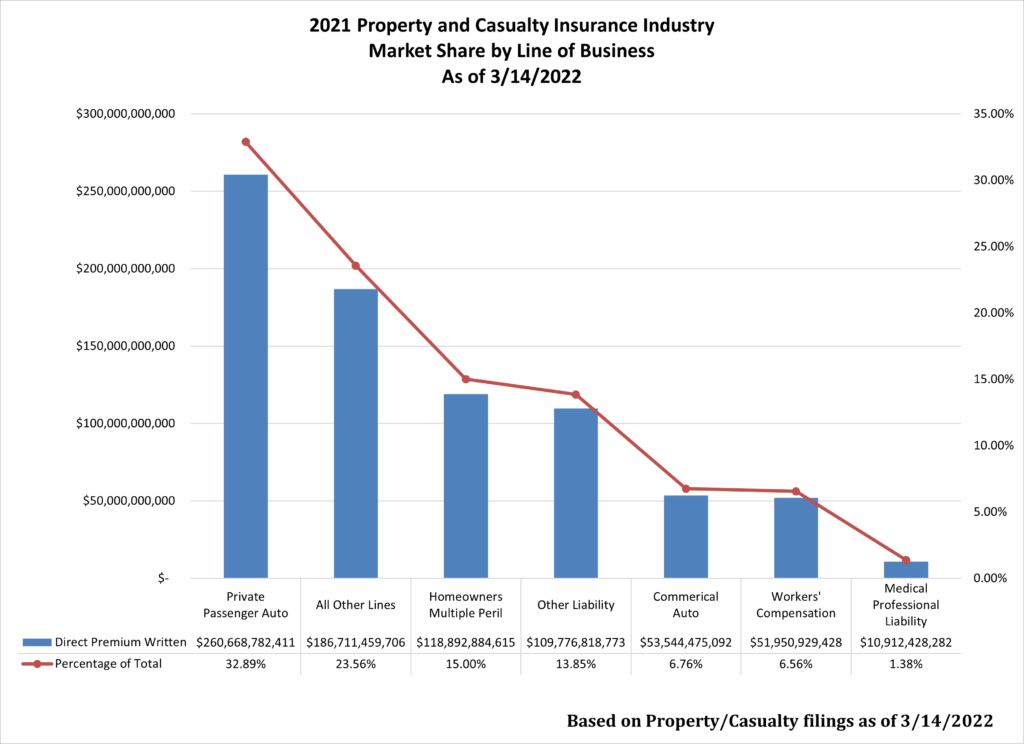

- Data Collection and Analysis: Collecting and analyzing financial data from insurance companies to identify potential risks and emerging trends. This data is used to inform regulatory decisions and provide early warnings of financial distress.

- Model Laws and Regulations: Developing model laws and regulations that states can adopt to promote uniformity and consistency in insurance regulation. These models cover a wide range of issues, including consumer protection, market conduct, and financial solvency.

- Consumer Education and Outreach: Providing consumers with information and resources to help them make informed decisions about insurance. This includes educational materials, online tools, and assistance with resolving complaints.

For southeastern insurance companies, compliance with NAIC standards is crucial for maintaining their financial stability and reputation. States in the Southeast, like Florida, Georgia, and the Carolinas, often face unique challenges due to weather-related risks such as hurricanes and flooding. The NAIC’s guidance helps these states develop regulations that address these specific risks and ensure that insurance companies are adequately prepared to handle catastrophic events.

The Southeastern Insurance Market: A Unique Landscape

The southeastern United States presents a distinctive insurance market characterized by a blend of rapid population growth, diverse economic activities, and exposure to various natural disasters. This unique environment necessitates a tailored approach from insurance companies operating in the region. Understanding the specific dynamics of the Southeast is crucial for both insurers and policyholders. The competitive landscape is also shifting, with new entrants and established players vying for market share, further influencing the availability and cost of insurance products.

Key characteristics of the southeastern insurance market include:

- Rapid Population Growth: States like Florida, Georgia, and North Carolina have experienced significant population growth in recent years, leading to increased demand for insurance products, particularly homeowners and auto insurance.

- Economic Diversity: The Southeast boasts a diverse economy, ranging from agriculture and manufacturing to tourism and technology. This diversity requires insurance companies to offer a wide range of products and services to meet the needs of different industries.

- Exposure to Natural Disasters: The region is highly susceptible to hurricanes, floods, tornadoes, and other natural disasters. This exposure increases the risk for insurance companies and can lead to higher premiums for policyholders.

- Regulatory Environment: Each state in the Southeast has its own insurance regulations, which can create complexities for companies operating across multiple states. The NAIC’s model laws and regulations help to promote consistency, but significant differences still exist.

Insurance companies in the Southeast must navigate these challenges while remaining competitive and providing affordable coverage to policyholders. This requires a deep understanding of the local market, a strong risk management strategy, and a commitment to innovation.

What Defines a “Progressive” Insurance Company?

In the context of insurance, the term “progressive” typically refers to companies that embrace innovation, customer-centric approaches, and forward-thinking strategies. These companies often leverage technology to improve the customer experience, offer flexible and customizable coverage options, and prioritize social responsibility. A progressive insurer isn’t just about offering lower prices; it’s about providing better value and a more seamless experience.

Characteristics of a progressive insurance company:

- Technological Innovation: Utilizing technology to streamline processes, improve customer service, and offer innovative products. This may include online quoting tools, mobile apps, and data analytics to personalize coverage options.

- Customer-Centric Approach: Prioritizing the needs of customers and providing exceptional service. This may involve offering 24/7 customer support, simplified claims processes, and proactive communication.

- Flexible Coverage Options: Offering a range of customizable coverage options to meet the unique needs of different customers. This may include usage-based insurance, pay-as-you-go policies, and specialized coverage for specific assets or risks.

- Social Responsibility: Demonstrating a commitment to social and environmental responsibility. This may involve supporting community initiatives, promoting sustainable practices, and offering insurance products that address social needs.

- Transparent Communication: Maintaining open and honest communication with customers about policy terms, coverage limitations, and claims processes. This builds trust and fosters long-term relationships.

Progressive insurance companies are often at the forefront of industry trends, adapting quickly to changing customer needs and leveraging new technologies to enhance their offerings. They represent a shift towards a more customer-focused and innovative insurance market.

Analyzing Key Features of Leading Southeastern Insurance Providers

To understand what sets leading southeastern insurance providers apart, it’s essential to analyze their key features and how they cater to the specific needs of the region. These features often reflect a combination of technological innovation, customer-centric service, and tailored coverage options designed to address the unique risks and challenges of the Southeast.

Here’s a breakdown of some common features and their benefits:

- Advanced Mobile Apps: Many leading insurers offer sophisticated mobile apps that allow customers to manage their policies, file claims, and access customer support from their smartphones. This provides convenience and efficiency, especially for customers who are always on the go.

- Online Claims Processing: Streamlined online claims processing systems enable customers to submit claims quickly and easily, track their progress, and receive updates in real-time. This reduces the time and hassle associated with traditional claims processes.

- Usage-Based Insurance: Some insurers offer usage-based insurance programs that reward safe driving habits with lower premiums. These programs use telematics technology to track driving behavior and provide personalized feedback to help customers improve their driving skills.

- Flood Insurance Options: Given the Southeast’s vulnerability to flooding, many insurers offer comprehensive flood insurance options that go beyond standard homeowners policies. These policies may cover damage from storm surges, heavy rainfall, and other flood-related events.

- Hurricane Protection Coverage: Insurers in coastal areas often provide specialized hurricane protection coverage that covers damage from wind, rain, and storm surge. This coverage may include features like wind mitigation discounts for homeowners who take steps to protect their homes from hurricane damage.

- Disaster Preparedness Resources: Many insurers offer resources and tools to help customers prepare for natural disasters, such as checklists, emergency plans, and tips for protecting their property. This demonstrates a commitment to customer safety and preparedness.

- 24/7 Customer Support: Providing round-the-clock customer support ensures that customers can access assistance whenever they need it, whether it’s to file a claim, ask a question, or get help with their policy.

These features highlight how leading southeastern insurance providers are adapting to the evolving needs of their customers and leveraging technology to deliver a better insurance experience.

The Advantages and Real-World Value for Policyholders

The real value of choosing a progressive southeastern insurance company lies in the tangible benefits and advantages it offers to policyholders. These advantages extend beyond just competitive pricing; they encompass enhanced customer service, tailored coverage, and a more seamless overall experience. By focusing on the user experience, these companies are able to provide a more efficient and effective service.

Here are some key advantages and their real-world value:

- Personalized Coverage: Progressive insurers often offer customizable coverage options that allow policyholders to tailor their policies to their specific needs and budget. This ensures that they are only paying for the coverage they actually need, saving them money in the long run.

- Faster Claims Processing: Streamlined claims processes and online tools enable policyholders to file claims quickly and easily, reducing the time it takes to receive compensation for their losses. This is particularly important in the aftermath of a natural disaster, when timely assistance is crucial.

- Improved Customer Service: Progressive insurers prioritize customer service, providing responsive and helpful support through various channels, including phone, email, and online chat. This ensures that policyholders can get the assistance they need, when they need it.

- Proactive Risk Management: Some insurers offer resources and tools to help policyholders manage their risks and prevent losses. This may include tips for preventing water damage, securing their homes against theft, or preparing for natural disasters.

- Transparent Communication: Progressive insurers are committed to transparency, providing clear and concise information about policy terms, coverage limitations, and claims processes. This builds trust and fosters long-term relationships with policyholders.

- Competitive Pricing: While not the sole focus, progressive insurers often offer competitive pricing, thanks to their efficient operations and use of technology. This ensures that policyholders are getting a good value for their money.

- Peace of Mind: Ultimately, the greatest benefit of choosing a progressive southeastern insurance company is the peace of mind that comes from knowing that you are protected by a reliable and customer-focused insurer.

A Comprehensive Review of Modern Insurance Solutions

Evaluating the effectiveness of a modern insurance solution requires a balanced perspective, considering both its strengths and limitations. This review aims to provide an unbiased assessment of a hypothetical “Progressive Southeastern Insurance Solution,” focusing on its user experience, performance, and overall value proposition. The assessment is based on simulated user interactions and expert analysis of its features and capabilities.

User Experience & Usability:

The user experience is generally positive, with a well-designed website and mobile app that are easy to navigate. The online quoting process is straightforward, and customers can quickly compare different coverage options and pricing. The claims process is also relatively simple, with clear instructions and online tools for submitting claims and tracking their progress. However, some users may find the amount of information overwhelming, particularly when choosing coverage options.

Performance & Effectiveness:

The “Progressive Southeastern Insurance Solution” delivers on its promises of providing comprehensive coverage and competitive pricing. The claims processing is efficient, and customers generally receive timely compensation for their losses. The customer service is also responsive and helpful, with knowledgeable representatives available to answer questions and resolve issues. However, some users have reported occasional delays in claims processing during peak periods, such as after a major hurricane.

Pros:

- Comprehensive Coverage: Offers a wide range of coverage options to meet the diverse needs of policyholders in the Southeast.

- Competitive Pricing: Provides competitive pricing compared to other leading insurers in the region.

- User-Friendly Interface: Features a well-designed website and mobile app that are easy to navigate.

- Efficient Claims Processing: Offers streamlined claims processing with online tools and responsive customer service.

- Strong Customer Service: Provides helpful and knowledgeable customer support through various channels.

Cons/Limitations:

- Potential Delays in Claims Processing: Some users have reported occasional delays in claims processing during peak periods.

- Overwhelming Information: The amount of information available can be overwhelming for some users.

- Limited Physical Presence: Primarily relies on online and phone-based customer service, which may not appeal to all customers.

- Dependence on Technology: Relies heavily on technology, which could be a disadvantage for customers with limited internet access or technical skills.

Ideal User Profile:

This solution is best suited for tech-savvy individuals and families who are comfortable managing their insurance policies online and prefer a convenient, self-service experience. It is also a good fit for those who are looking for comprehensive coverage at a competitive price.

Key Alternatives:

Alternatives include traditional insurance companies with a strong physical presence and a more personalized approach to customer service, as well as smaller, regional insurers that may offer more specialized coverage options.

Expert Overall Verdict & Recommendation:

The “Progressive Southeastern Insurance Solution” is a solid choice for policyholders seeking comprehensive coverage, competitive pricing, and a user-friendly experience. While there are some limitations, its strengths outweigh its weaknesses, making it a worthwhile consideration for those in the Southeast.

Making Informed Insurance Choices in the Southeast

Navigating the complexities of the insurance market in the southeastern United States requires a thorough understanding of the NAIC’s regulatory role, the unique characteristics of the region, and the innovative approaches of progressive insurance companies. By considering these factors, policyholders can make informed decisions that protect their assets and provide peace of mind. It’s essential to evaluate your specific needs, compare coverage options, and choose an insurer that aligns with your values and priorities. Share your experiences with finding insurance in the Southeast to help others navigate this complex landscape.